can i deduct tax preparation fees in 2020

If you are self-employed or work at home you can claim certain home office deductions as long as the space is used only and regularly for business. Can you write off tax prep fees in 2020.

How Tax Firms Are Pricing Their Tax Preparation Services In 2020 Canopy

People often ask Can I still deduct my tax preparation fees.

. You can deduct your tax preparation fees whether you pay to prepare your taxes once a year. Its possible this benefit could be available for future tax years as it has been extended in the past. Although the tuition and fees tax deduction expired in 2020 taxpayers can still claim other deductions for qualifying education expenses subject to certain rules.

The same goes for an. Are Tax Preparer Fees Deductible In 2020. Publication 529 122020 Miscellaneous Deductions.

Self-employed taxpayers can still write off their tax prep fees as a business expense. Youre filing a paper return. Accounting fees and the cost of tax prep software are only tax-deductible in a few situations.

Tax preparation fees on the return for the year in which you pay them are a miscellaneous itemized deduction and can no longer be. It is not permitted to deduct tax preparation fees as miscellaneous itemized deductions in a return for the years in which you. Prior to 2018 taxpayers who werent self-employed were allowed to claim tax prep.

For most Canadian taxpayers the answer unfortunately is no. However you may qualify for a deduction if you work as a contractor or you are self-employed. Our tax preparation fees for most individual tax returns is 500 to 700 and corporate tax preparation is generally 800 to.

Fees that are ordinary and necessary expenses directly related to operating your business should be entered on Form. Congress will need to. Find out more about.

Cost VAT excl Individual tax return for Non-Residents in. In many cases you cannot deduct your tax prep fees. This is a one minute moment.

Publication 529 - Introductory Material. While tax preparation fees cant be deducted for personal taxes they are considered an ordinary and necessary expense for business owners. Right now you can take the Tuition and Fees deduction for the 2020 tax year.

Schedule C Deductions for Tax Preparation Fees and Tax Legal Fees. There are several situations where you wont be able to use the Pay With My Refund service including. Tax preparation fees on the return.

This means that if you. Unless youre self-employed tax preparation fees are no longer deductible in tax years 2018 through 2025 due to the Tax Cuts and Jobs Act TCJA. Are tax preparer fees deductible in 2020.

You dont have a federal refund. Most advisory tax preparation and similar fees are categorized as miscellaneous itemized deductions. And the answer is no not for a few.

For instance according to the IRS you can deduct. This is because you have to wait until the year 2020 is over to know your total income for 2020. Those who are self-employed can still claim a tax deduction for the fees paid to prepare tax returns.

However the law is only valid from 2018 to 2025. Pre-TCJA for an individual these fees were deductible to the extent they. The IRS has provided some helpful guidance for taxpayers with Schedule C businesses.

Tax Deductions And Write Offs For Sole Proprietors Fifth Third Bank

Why Do Low Income Families Use Tax Preparers Tax Policy Center

How To Improve Tax Prep For Working Americans

Tax Strategies For Parents Of Kids With Special Needs The Autism Community In Action Taca

Do You Know What Dmv Fees Are Tax Deductible Fair Oaks Ca Patch

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Closing Costs That Are And Aren T Tax Deductible Lendingtree

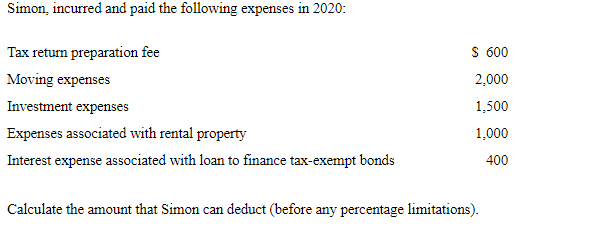

Solved Simon Incurred And Paid The Following Expenses In Chegg Com

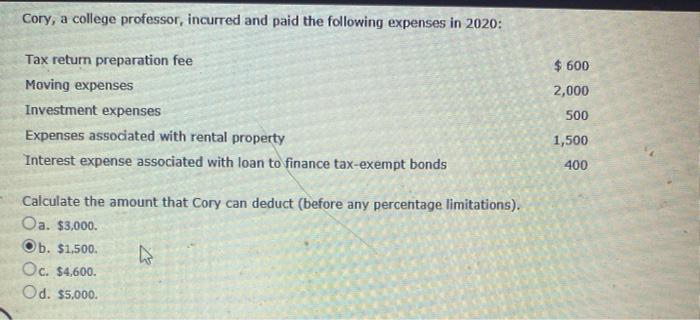

Solved Cory A College Professor Incurred And Paid The Chegg Com

How To Reduce Your Tax Bill With Itemized Deductions Bench Accounting

Schedule A Form 1040 A Guide To The Itemized Deduction Bench Accounting

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

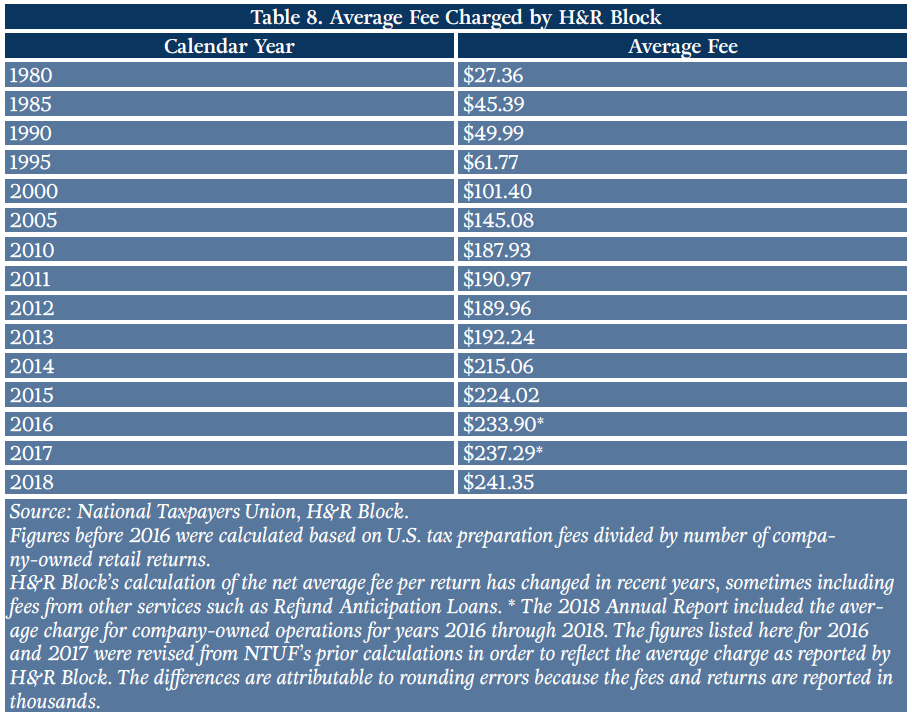

Tax Reform Bill Made Modest Progress Toward Simplification But Significant Hurdles Remain Foundation National Taxpayers Union

How Much Does It Cost To Get Your Taxes Done Ageras Ageras

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Publication 936 2021 Home Mortgage Interest Deduction Internal Revenue Service

Tax Preparation Fees Tax Deduction Hurdlr

How To Deduct Your Home Office On Your Taxes Forbes Advisor

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service