irs tax levy letter

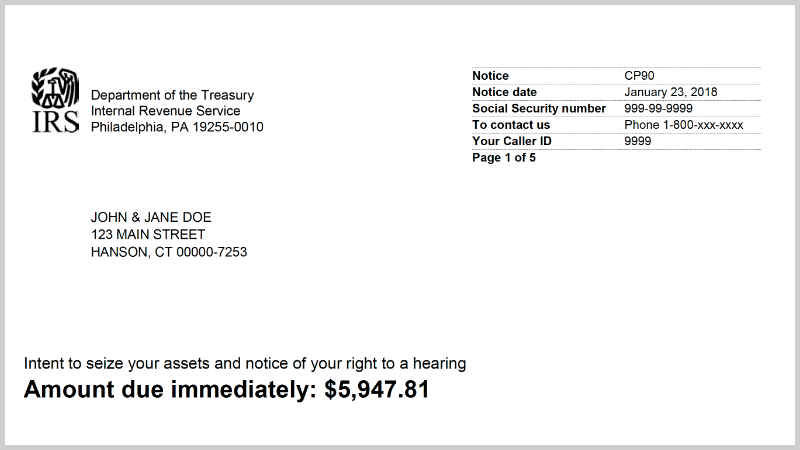

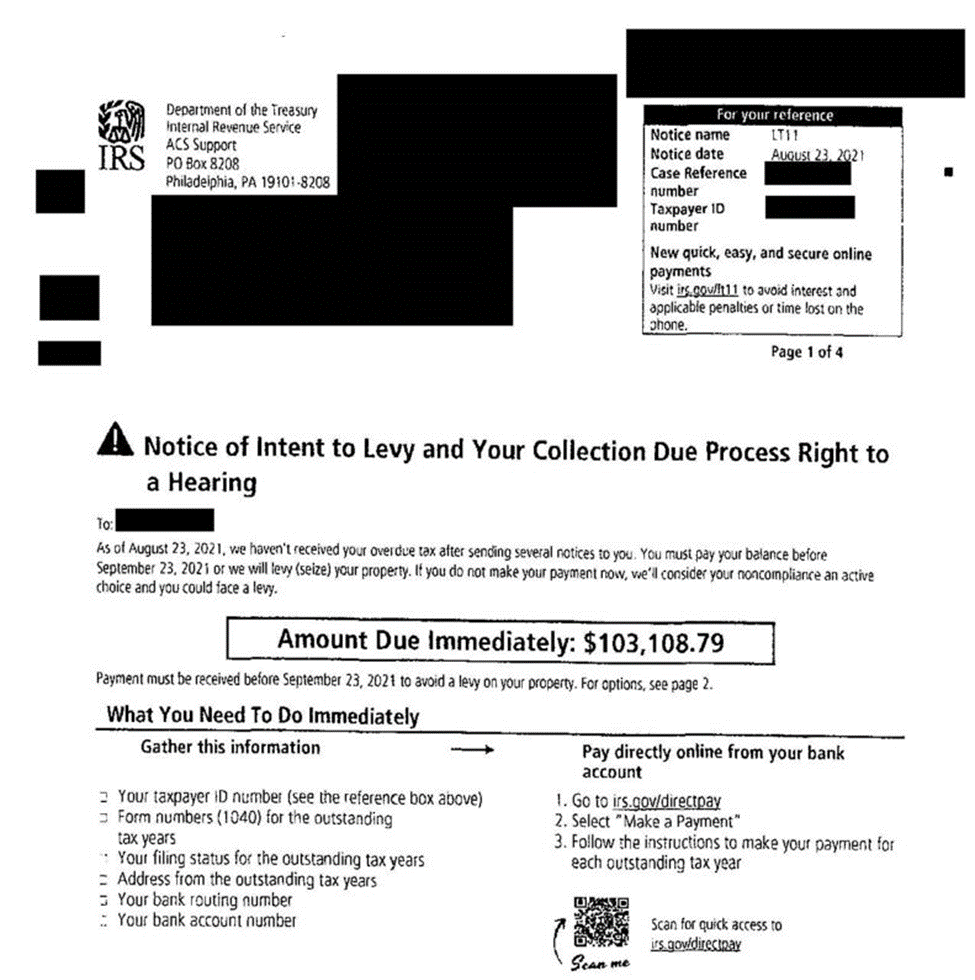

Letter 11 Final Notice of Intent to Levy and Notice of Your Right to a Hearing. Contact the Treasury Inspector General for Tax Administration to report the letter.

The period for collection ended before it issued the levy.

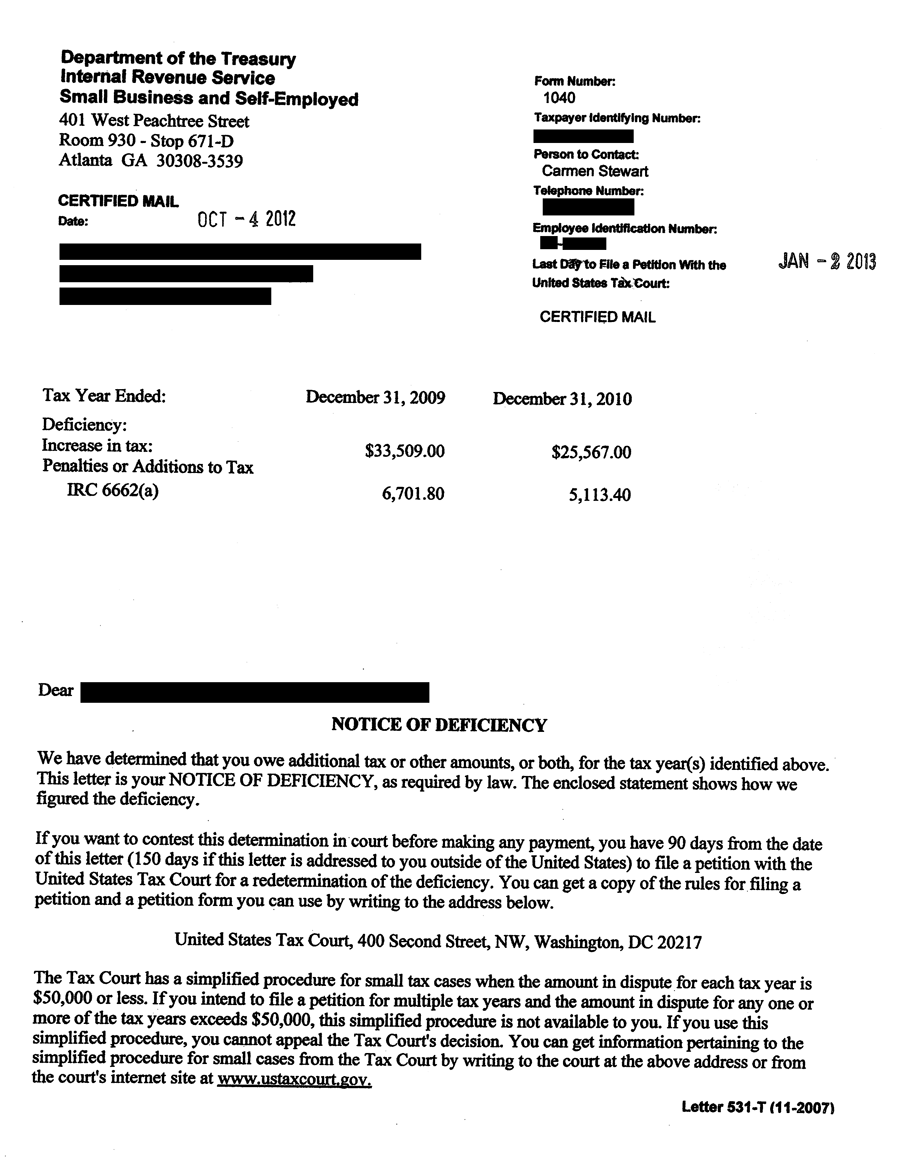

. A tax lien is a tool the IRS uses to make a legal claim against property you own to secure payment of any tax debt you owe. This notice is usually only sent when there is an extreme delinquent tax. A levy refers to the seizure of your assets to resolve unpaid debts.

If the IRS still did not hear from you they sent you notice that a Notice of Federal Tax Lien was. The taxpayer should use their IRS Impersonation Scam Reporting webpage. You paid the amount you owe.

Typical targets for seizure include your bank accounts retirement accounts wages independent contractor. The IRS may give you this notice in. This is often done by sending you a warning letter in the mail.

The IRS must release a levy if it determines that. This letter is required by IRC 6331 before the IRS issues a levy unless collection is in jeopardy to collect tax from most sources. For instance you may receive an IRS garnishment letter.

However you would like. The levy notice can vary depending on which assets the IRS plans to seize. Taxpayers are not entitled to a pre-levy hearing.

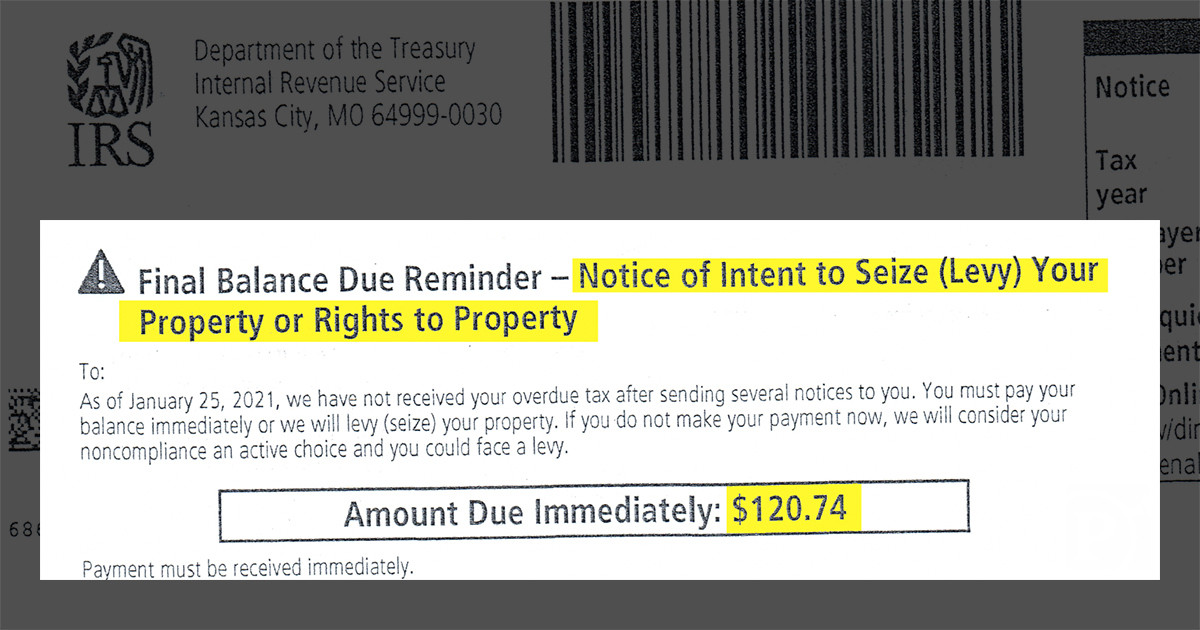

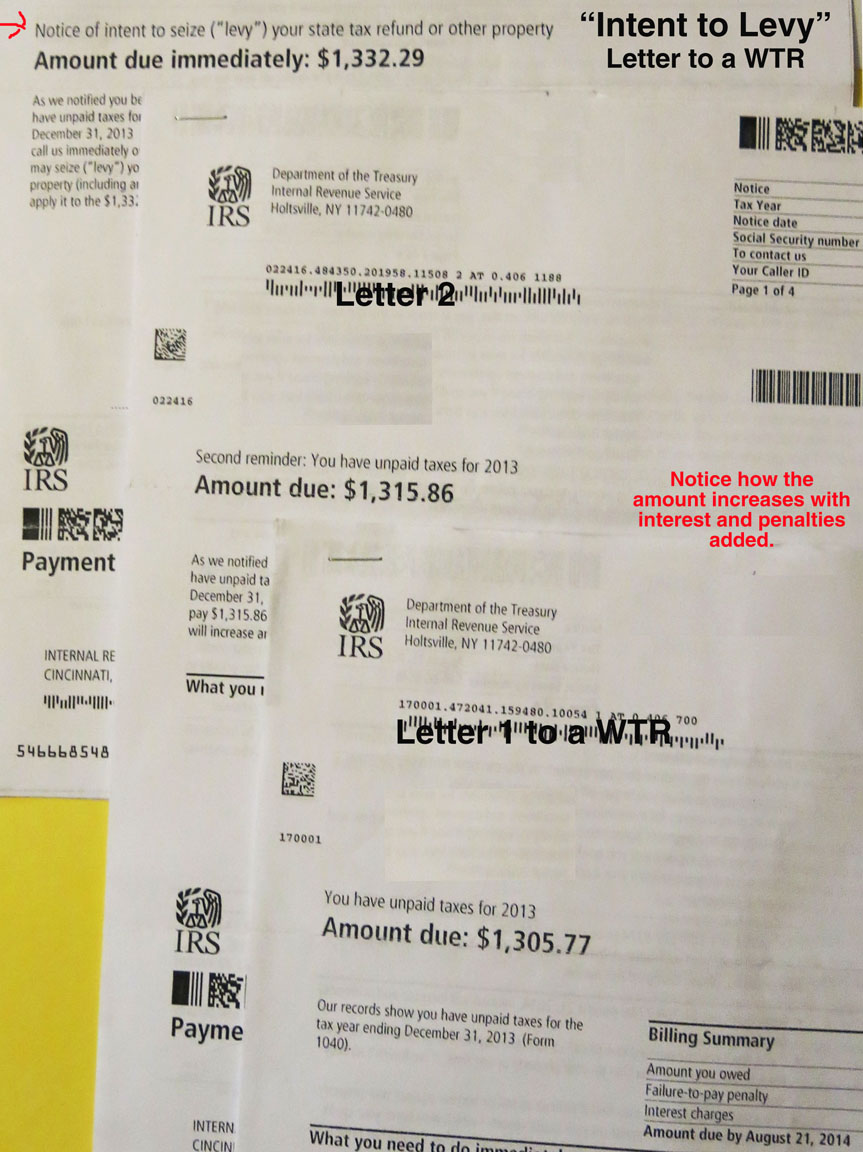

An IRS Notice of Intent to Levy is a notice that the IRS sends if there are plans to seize your assets. This includes any property you acquire after the IRS. The first thing to do is to check the return address to be sure the letter or notice is from the Internal Revenue Service and not another agency or a scammer.

This means that the IRS plans to garnish your wages. This letter notifies you of your unpaid taxes and that the Service intends to levy to collect the amount owed. The levy proceeds have been received by the IRS and applied to your tax debt.

It will help you. When the IRS processes your refund the BFS notes that you have an unpaid child support liability. It sends you a notice of intent to offset that says 3000 of your refund will be applied to your.

The IRS is notifying the delinquent taxpayer that they will begin. The IRS sent you a Final Notice of Intent to Levy and Notice of Your Right to A Hearing levy notice at least 30 days before the levy. The IRS is required to send you notice of its intention to levy at least 30 calendar days before initiating the levy action.

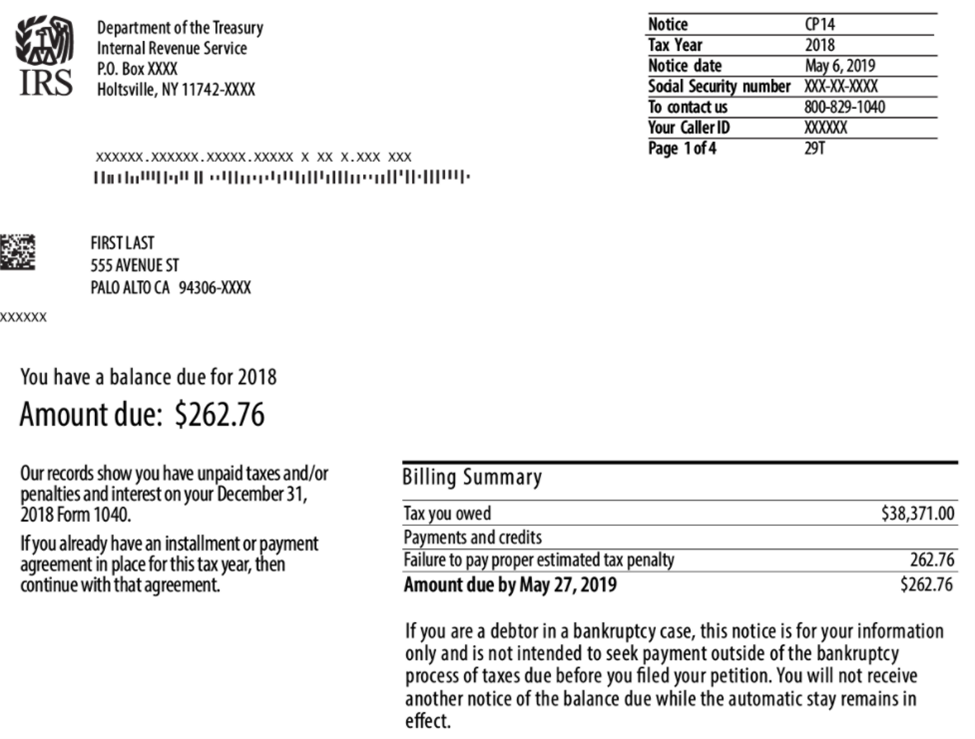

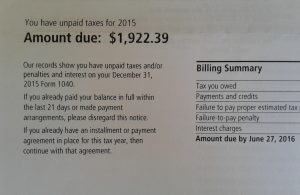

You have a balance on your tax account so the IRS sent you a notice or letter. The IRS has issued a levy to collect on the balance that you owe. An IRS Notice of Levy is a letter sent to taxpayers who have not paid their back taxes and have an IRS lien placed against them.

Getting a levy released.

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

The Irs Sent You A Final Notice Of Intent To Levy And Notice Of Your Right To A Hearing What Should You Do Now Brandon A Keim Phoenix Tax Attorney

Understanding Common Irs Collection Letters National War Tax Resistance Coordinating Committee

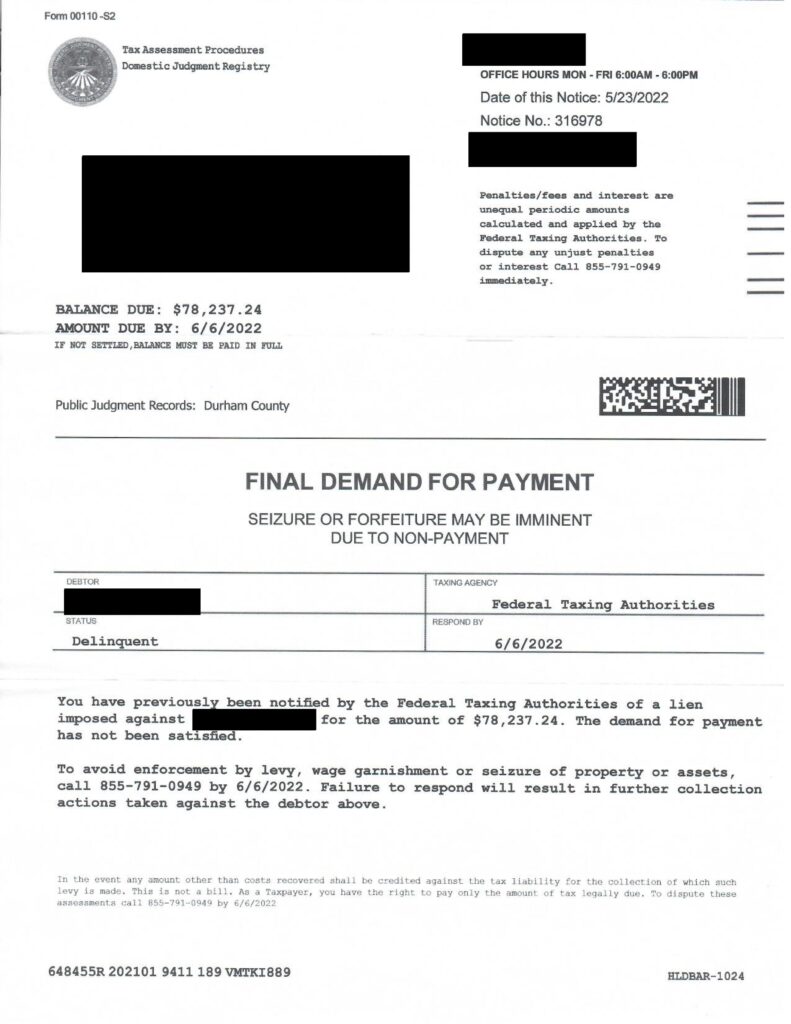

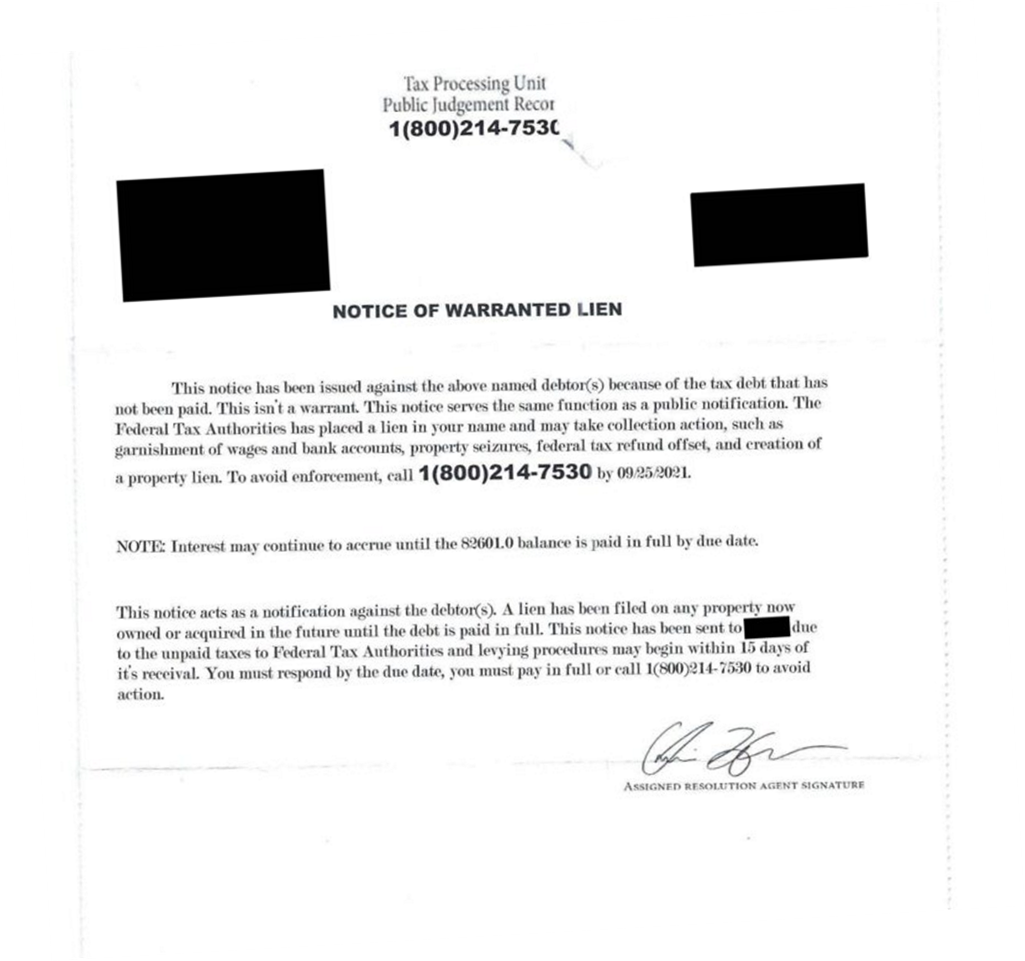

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Notice Cp 90 297 297a Notice Of Levy And Right To A Hearing Tax Defense Group

Irs Notice Cp523 Understanding Irs Notice Cp 523 Intent To Terminate Your Installment Agreement Seize Your Assets Pending

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block

Irs Tax Notices Explained Landmark Tax Group

Irs Notices And Irs Letters Has The Irs Contacted You Protect Assets From Seizure

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

Irs Tax Levies Franskoviak Tax Solutions Solving Tax Levy Issues

Irs Tax Letters Explained Landmark Tax Group

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

Tax Letters Washington Tax Services

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

More On Irs Collection Tactics National War Tax Resistance Coordinating Committee

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block